New alumni association created.

Text: Jolanda Bucher

Actuarial science has been taught at the University of Basel for 80 years now. This makes the program one of the oldest German-language courses in the field. This year’s anniversary event included the launch of the actuarial science alumni association.

On 6 February 1939, the University of Basel introduced actuarial science as a separate examination subject. And 80 years later to the day, the alumni association AlumniActuarialScience was formed. Around 90 alumni, students, university staff and guests with an interest in the program took part in the anniversary celebrations at the Old University. Knowledge and information transfer were a central theme of the event. Two students presented their recently concluded master’s projects to the specialist audience. During the drinks reception and subsequent meal for the body’s new members, old acquaintances were refreshed and new contacts forged — an all-round success for the launch of the new alumni organization.

Giving something back

Plans for the new association include a yearly meeting on 6 February in collaboration with the Master’s Program in Actuarial Science and an alumni group in Zurich. The purpose of the alumni organization is to support friendships, networking and contact with sponsors and industry, besides promoting teaching and research in the field of actuarial science at the University of Basel. The driving force behind the initiative is a sense of connection to the university — for alumni, it is a way of giving something back.

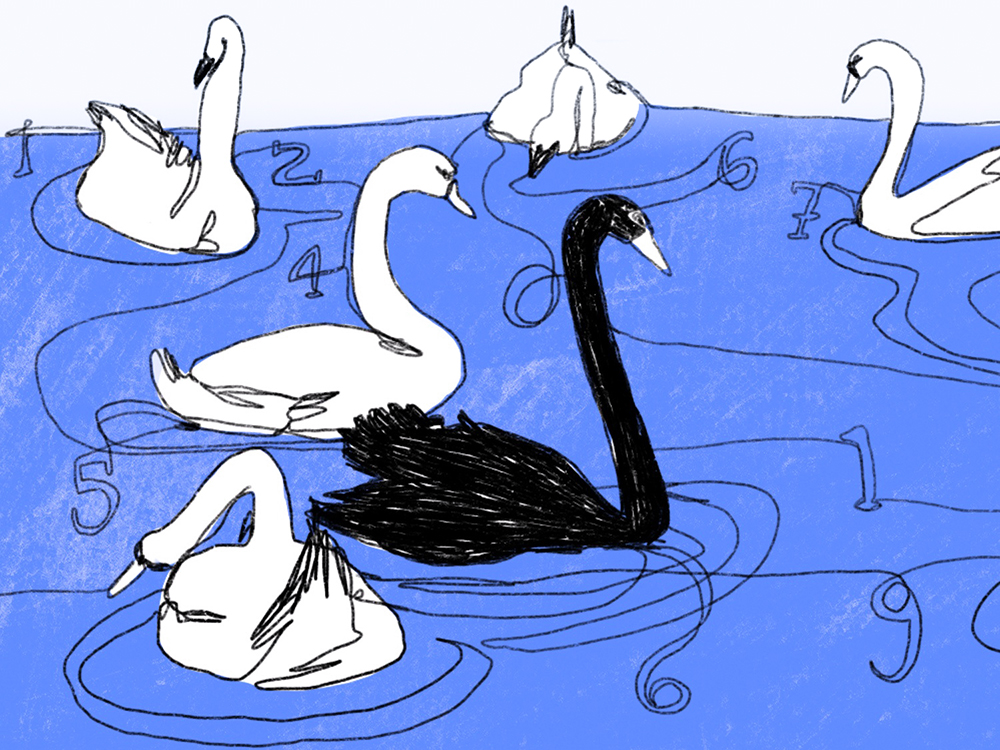

Before they reached Australia, the inhabitants of the Old World believed that all swans were white. This conviction was unshakeable – all the empirical evidence appeared to back it up. When Dutch explorers spotted the first black swan in western Australia in 1697, this belief was turned on its head: something previously thought to be impossible had occurred. Since then, the expression “black swan” has been used as a metaphor for a highly unlikely event with major repercussions, often causing existing theories to be revised or expanded.

Black swans aplenty

In practice, actuaries encounter numerous black swans, which have momentous effects on trends in the financial and insurance markets. The extraordinary success of Google and Amazon, the attacks of September 11, the global banking and financial crisis of 2008, the 2011 nuclear disaster in Fukushima or the meteoric rise of the World Wide Web in the 1990s are all examples of these extremely rare events with far-reaching consequences.

One of the key tasks of actuarial science is assessing the likelihood of black swans, their impact on the financial and insurance markets, and the opportunities and risks they present. Doing so enables the vast implications of these events to be taken into account in the calculation of insolvency probabilities, riskbased premiums and appropriate claim reserves – and thereby at least partially managed. Actuaries therefore not only contribute to the ongoing success of the insurance and banking industries but also play a significant role in the proper functioning of social security systems and positive economic development.

More articles in the current issue of UNI NOVA.