Joseph and the speculators

Professor Heinz Zimmermann

Commodity futures trading is often the subject of public debate: To what extent can it be called enterprising commercial trade, and when does it become speculation?

Joseph’s interpretation of the Pharaoh’s dream saved Egypt from a famine: In the seven years of plenty, grain was stored in large quantities so that in the subsequent lean years it could be sold to the starving population – and not distributed freely as one is sometimes taught in religion classes. Since we learn nothing in the sources about the purchase price in the years of plenty or the selling price in the lean years, the economic dimensions of the biblical tale remain in the dark. In addition, Joseph was clearly in possession of a state monopoly both for the storage and trade of grain. Futures transactions are not mentioned, although these did already exist widely in the form of grain credits.

How would things have been different if a competitive market system had operated rather than Joseph’s providence and monopoly? When expecting a shortage, the owners of storehouses would only have stored the grain over years if the eventual selling price was predicted to recompense them for the cost of storage and the cost of capital tie-up. In contrast to Joseph they are exposed to a price risk, just like the bakers who live with the uncertainty regarding how much they will have to pay for grain in the lean years. This uncertainty, at least with regard to the price risk, could be removed through futures transactions: those who run the warehouses undertake to sell the stored grain in one, two or three years’ time at a fixed price agreed today (the forward price).

If poor harvests are expected, the forward price curve will rise and so create an incentive to store the cereal and to counteract the expected shortage. For the bakers and for consumers, this makes it possible to buy grain at a price that is indeed higher but which is also guaranteed and so can be planned for. If the shortage exists now and better times are expected, then the current price would be greater than the future forward price and the traders would have an incentive to empty their warehouses now.

The Bible story shows the following: With perfect foresight and a state monopoly, society needs no futures market to transfer goods from a period of plenty to a period of shortage. In a competitive sys - tem, however, with uncertain price expectations and decentralized decision-making, a futures market fulfi lls a role not only in safeguarding against false expectations but also has a role in co-ordination. The futures market creates prices for a range of future delivery dates, and the difference between them – the so-called forward curve – shows the actors how to change the conditions. It is not surprising then that with current development projects on the security of supply, investment in the building of storage capacity and organized future markets, as well as the infrastructure required for this are all given high priority. In addition to their relation to storage, futures markets also give important signals with regard to the planning of future production capacity.

So why is commodity futures trading so often the subject of public debate? For public opinion, three issues are of decisive importance. First: There is not merely “one” forward contract. Rather, there is a countless range of contracts traded on the stock exchange and outside the stock exchange, as well as investment products derived from these contracts. These are often difficult to understand. The most important are the futures contracts: These are standardized forward contracts that are traded on stock markets especially designed for this purpose. Usually, these contracts demand no direct physical relationship with the commodity traded but are, rather, focused on the balancing out of price fluctuations. Stock-exchange trading opens up contracts to a broad public with very different trading purposes and makes possible a liquid and transparent market.

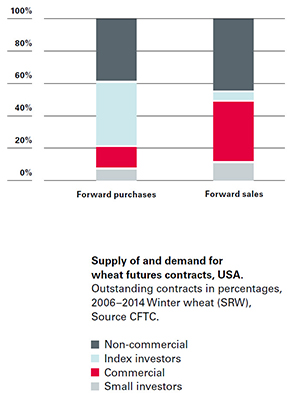

Second: In the story of Joseph, only the commercial stakeholders are mentioned. Warehouse owners and bakers, to whose numbers the producers, processors, and traders may also be counted. A futures market with exclusively commercial actors may seem like an ideal case, but in fact it would have little chance of survival, or indeed, given the imbalance between forward purchases and forward sales, it may not even be capable existing in the first place. Let us consider winter wheat. Here, the ratio of buying and selling futures is approximately 1 to 3 (between 2006 and 2014). This means that the overwhelming number of commercial participants in the market are securing themselves through sales against falling wheat prices. However, actors are required to make up for the imbalance through forward purchases – actors with no commercial interest in wheat: speculators. Yet who exactly are these actors? Hedge fund managers with an enormous appetite for risk? Pension fund investors in commodity certificates? But is not an entrepreneur also speculating by storing his product in warehouses in expectation of a rise in prices? Or does something only become speculation when there is no commercial objective behind it? When Joseph stored the grain, was his objective commercial or speculative?

Unclear, imprecise or emotionally biased terms make up the third category of factors that influence the formation of opinion. The step to banning speculation with commodity futures from the familiar imperative “do not play with your food” is short, and one that is seldom challenged due to a lack of a clear understanding of the meaning of speculation. Is a trader speculating when he secures his stock by selling futures? Hardly. And if he does not secure it? In that case it would be logical to call him a speculator. Correct – and it becomes evident that, in some instances, it is precisely the refraining from the use of financial tools that constitutes speculation.

Without knowledge of the actor’s economic context, it is mostly impossible to determine whether their actions are speculation in the economic sense or not. This also explains the fact that the US regulating authorities distinguish only between commercial and non-commercial positions (and recently index positions) and avoid the term ‘speculation’. For US winter wheat, the non-commercial positions (institutional investors such as funds, banks, and pension funds) are quite well balanced in terms of value between forward purchases and forward sales, and so the commercial imbalance mentioned above will be balanced out by the remaining actors, particularly by the index investors group. What do they do? In contrast to classic speculation, they invest in the commodities segment for reasons of diversification, namely in diverse assets tied to a commodity index. This ensures that the commodity risks are more widely spread, which reduces the hedging costs. Indexed assets have enjoyed a boom with the emerging phase of low interest rates. Over the same time, there has been a massive rise in the price of a range of foodstuff s on the world market, and this has rekindled the old debate – also in scientific research – on the damaging effects of commodity futures speculation. A new metastudy of one hundred newer works concludes, however, that a systematic damaging influence cannot be proven empirically.

The current debate is by no means new. In German-speaking countries, the prohibition of grain futures in 1896 was the culmination of years of debate, “the settling of which through legislation was always guided more by consideration of the prevailing contemporary ‘beliefs’ of the populace rather than by any insights provided by science”, as August Fröchtling explained in an essay in 1909. Former members of the exchange commission professors Max Weber and Gustav Cohn were even clearer, claiming that the limitations and prohibitions were the result of “an outflowing of herd instincts led astray”. What had happened? In the course of globalization, imports from overseas grew massively in spite of rises in customs duty. This led to lower prices and an increase in fluctuations in prices. The landowners made forward trading partially responsible for this and prevailed politically against the capitalists. The hoped-for price stabilization did not arrive. The lack of a risk transfer between producers and consumers destabilized the grain price to such an extent that by April 1900 the market opened again. The revival failed, however, and the once leading grain exchange lost its national significance.

With a few exceptions, the discussion today is less about prohibitions than about introducing stricter limits on positions and on trading for noncommercial actors. Limits are as old as the exchanges themselves and their purpose is indeed to restrict excessive speculation. The aim was always to protect the market mechanism from criminal behavior by the actors in the market, above all from price manipulation. The aim was not to exclude certain actors on the basis of supposed unethical trading purposes. In this lies a decisive difference to the current debate.

Heinz Zimmermann is Professor of Financial Market Theory at the University of Basel. His latest work focuses on topics such as the role of speculation and stocks on commodity futures markets.