Risk-taking from a psychological perspective

Is it possible to predict the decisions people make?

For example, the risk someone is willing to accept when making financial choices? Thanks to new innovative approaches, psychology professor Rui Mata hopes to get better and better at such predictions.

Some decisions can have crucial consequences for people’s lives. For Rui Mata, the decision to do his doctoral studies at the Max Planck Institute for Human Development in Berlin ultimately led to a professorship in psychology at the University of Basel. As head of the Center for Cognitive and Decision Sciences, he is now investigating how people make decisions concerning health and wealth across the life span.

Rui Mata studied psychology at the University of Lisbon, Portugal. «At school, I liked philosophy and biology, and psychology seemed like a good mix of perspectives,» says Mata, «this still holds up today. Psychology is like a hub that is connected to many other disciplines. You can look at a question from different viewpoints and make new connections, which I find extremely exciting.»

Psychological factors determine financial portfolios

One example of such an interface is the Swiss National Science Foundation-funded Sinergia project «The Foundations of Successful Financial Decisions», a collaboration between research groups in the fields of psychology and economics from the Universities of Basel and Zurich. The team is studying how people make decisions regarding their private finances. «This question is particularly important in Switzerland because people have a lot of choice concerning their financial decisions, such as saving for retirement» Mata said.

For the project, the researchers are analyzing real financial portfolios and relating these to a series of psychological tests and neuroimaging indices with the investors. The results suggest that some psychological traits play an important role increase the willingness to take financial risks. «Such findings may help to better formulate customer information about financial products and, ultimately, help people make more advantageous financial decisions», says Mata. He is particularly interested in whether risk appetite remains constant throughout life or changes with age. So far, the scientific evidence on this question is still contradictory and data about people’s real-world financial choices is lacking, which makes studies that analyze real financial portfolios particularly valuable.

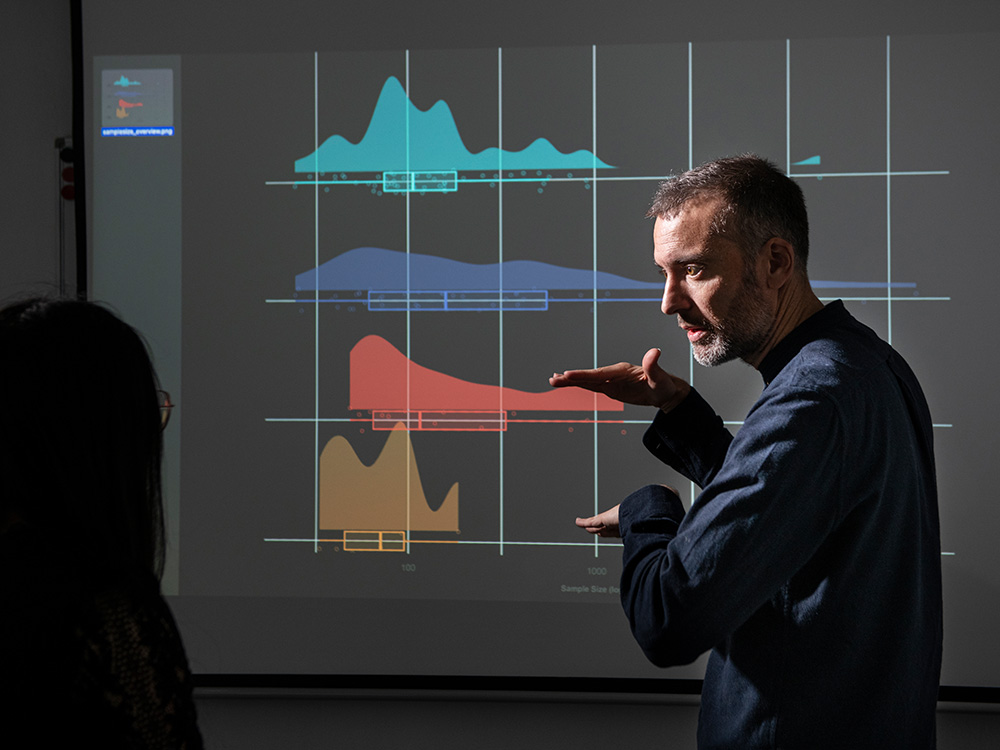

Artificial intelligence for language analysis

That's one reason Mata is constantly searching and evaluating new methods for their use in decision research. In his newest approach, he is taking advantage of recent advances in computer science. «Until now, risk preference has been measured mainly by playing artificial computerized games, in which participants have to decide, for example, how much money to bet.» Now Mata and his team want to collect data and predict behavior in the real world. For this purpose, the rely on machine learning algorithms to comb through different kinds of texts and filter out specific features to predict individuals’ risk perceptions and behavior, for example, people’s reactions to natural catastrophes or events on the stock market.

«This could be a treasure trove of new data on risk behavior for us researchers in psychology», Mata says. He plans to compare the models that were trained with these data with models from other methodological approaches. This could help clarify the question of whether or not people like to take more risks with increasing age. In the spirit of open science, he plans to make the programs developed in this project freely available to other research groups, which will allow the analysis and comparison of data sets around the world.

Inspiration from many countries and disciplines

Mata attributes his open-mindedness toward interdisciplinary projects to his time as a doctoral student at the «International Max Planck Research School on the Life Course» – a program in which students collaborate with research groups at different institutions. Mata has gained further research experience during his time as a postdoctoral researcher at the universities of Lisbon, Michigan, and Stanford. In 2014, he was appointed professor at the University of Basel.

Mata cultivates an international flair not only professionally but also in his private life. His wife, a professor of health psychology at the University of Mannheim, is from Germany. Their two primary-school-age daughters feel at home here in Basel and speak Swiss German better than Portuguese. «My hobbies are also becoming more Swiss. I particularly like to go hiking and running in the mountains», Mata says.

Further Links

- Faculty of Psychology

- Center for Cognitive and Decision Sciences

- The Foundations of Successful Financial Decision Making (SNSF Sinergia)

- Age differences in risk taking (SNSF project)

- What is risk preference? Using data-driven ontologies and meta-analyses to inform and achieve expert consensus (SNSF Project)

- Rui Mata in the Uni News